Calculate my income tax

If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667. Did you work for an.

How To Calculate Income Tax In Excel

Your average tax rate.

. Income Liable to Tax at Normal Rate --- Short Term Capital Gains Covered us 111A 15 Long Term Capital Gains Charged to tax 20 20 Long Term Capital Gains Charged to tax. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Use this calculator to help determine whether you.

Ad Find process serving you can trust read reviews to compare. Use this calculator to work out your basic yearly tax for any year from 2011 to the current year. However a flat rate of 5 applies to taxable income over.

Estimate your Income Tax for the current year Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6 April 2022. How much Australian income tax you should be paying what your take home salary will be when tax and the Medicare levy are removed your marginal tax rate This. The Minnesota Tax Calculator Lets You Calculate Your State Taxes For the Tax Year.

Social Security benefits are 100 tax-free when your income is low. Your bracket depends on your taxable income and filing status. That means that your net pay will be 43041 per year or 3587 per month.

Income Filing Status State More options After-Tax Income 57688 After-Tax Income. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. The first 9950 is taxed at 10 995 The next 30575 is taxed.

Review Process Serving profiles see prior experience compare prices in one place. Starting in 2022 there is no state income tax on the first 5000 of taxable income in Mississippi. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

For instance it is common for working. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Federal Income Tax Return Calculator Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax.

There are seven federal tax brackets for the 2021 tax year. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. It will not include any tax credits you may be entitled to for example the.

Massachusetts Income Tax Calculator 2021. Your average tax rate is 1198 and your. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your.

Helps you work out. Up to 10 cash. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income.

Ad Whatever Your Investing Goals. Using the brackets above you can calculate the tax for a single person with a taxable income of 41049. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Ad Ensure Accuracy Prove Compliance Prepare Quick Easy-To-Understand Financial Reports. 10 12 22 24 32 35 and 37. All Income tax dates.

1 day agoIn general the administration said eligible taxpayers will receive a credit in the form of a refund that is approximately 13 of their Massachusetts Tax Year 2021 personal income tax. Balers office said Friday the 13 is a preliminary estimate and will be finalized in late October after all 2021 tax returns are filed To be eligible you must have paid personal. Make Smart Choices For Your Business and Save Time On Accounting Invoicing.

This calculator computes federal income taxes state income taxes social security taxes medicare taxes self-employment tax capital gains tax and the net investment tax. That means that your net pay will be 40568 per year or 3381 per month. Prices to suit all budgets.

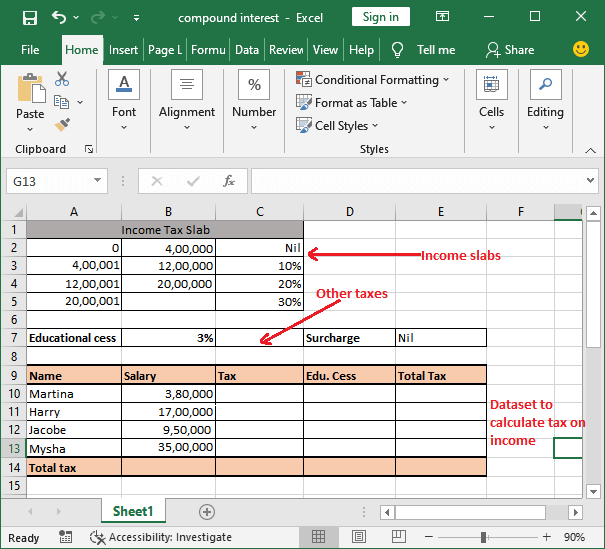

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

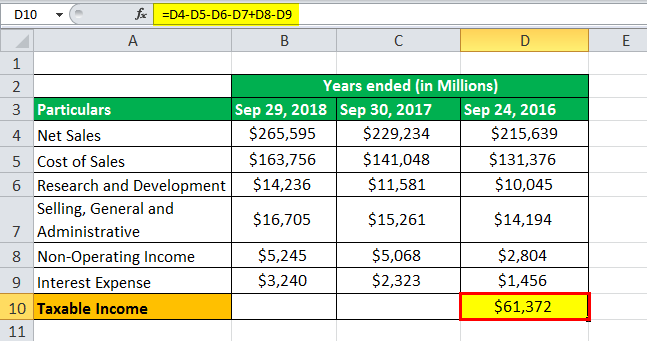

Taxable Income Formula Examples How To Calculate Taxable Income

How To Calculate Income Tax In Excel

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Excel Formula Income Tax Bracket Calculation Exceljet

How To Calculate Income Tax In Excel

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

How To Calculate Income Tax In Excel

How Is Taxable Income Calculated How To Calculate Tax Liability

Income Tax Calculating Formula In Excel Javatpoint

How To Calculate Federal Income Tax

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet